Tesla, once the dominant force in the European electric vehicle market, is experiencing a significant decline. Sales have dropped by 19% in the last quarter, and its market share has fallen from 21% to less than 14% in one year. Key factors include controversies surrounding Elon Musk, fierce competition from Chinese and European automakers, reduced government subsidies, and recurring quality and service issues. To recover, Tesla must distance itself from Musk’s polarizing image, develop Europe-specific models, improve quality and service, and adopt more competitive pricing strategies. The company’s future in Europe depends on its ability to adapt to a rapidly changing market and regain consumer trust.

The Unexpected Fall of Tesla in Europe

Introduction: Tesla’s European Decline

Tesla, the American electric vehicle (EV) giant, is facing unprecedented challenges in the European market. Once seen as the undisputed leader of the EV revolution, Tesla’s dominance is eroding at an alarming pace. Recent sales data shows a 19% drop in the last quarter, with its European market share plummeting from 21% to less than 14% in just one year.

This decline stems from a mix of factors: controversies surrounding CEO Elon Musk, fierce competition, shifting economic conditions, and questionable strategic decisions. How did Tesla, the brightest star in the automotive industry, lose its shine so quickly? This analysis reveals the unexpected vulnerabilities of a company many believed was untouchable.

The Numbers Speak: A Sharp Decline in Sales

Tesla’s Falling Registrations

Tesla’s vehicle registrations in Europe have been on a steady decline over the past year. The drop accelerated in 2023, with registrations falling by 9% in January, 15% in April, 22% in July, and a worrying 28% in October compared to the previous year.

Market-Specific Declines

The decline varies across European markets:

- Germany: Tesla’s former stronghold saw a 42% drop in new registrations.

- Netherlands: Registrations fell by 37%.

- France and Sweden: Declines of 31% and 29%, respectively.

- Norway: The only market holding up relatively well, with an 11% drop, thanks to strong EV-friendly policies.

Stock Market Impact

Tesla’s stock has lost over 40% of its value since its peak in November 2021, wiping out nearly $500 billion in market capitalization. Analysts warn that the European slowdown could signal deeper troubles for the company.

Elon Musk: A Liability for Tesla in Europe?

Controversial Statements and Political Backlash

Elon Musk’s polarizing statements have significantly damaged Tesla’s reputation in Europe. His support for Donald Trump, favorable comments toward Germany’s far-right AfD party, and controversial views on environmental and social issues have alienated European consumers, who are more sensitive to these topics than their American counterparts.

Consumer Sentiment

A survey across five European countries revealed that 61% of current Tesla owners are “less likely” to buy the brand again, citing Musk’s political positions as the primary reason. Movements like #TeslaExit and petitions against Tesla purchases by public entities (e.g., 200,000 signatures in Sweden) highlight the growing backlash.

Rising Competition: Tesla’s Market Share Under Threat

Chinese Competitors

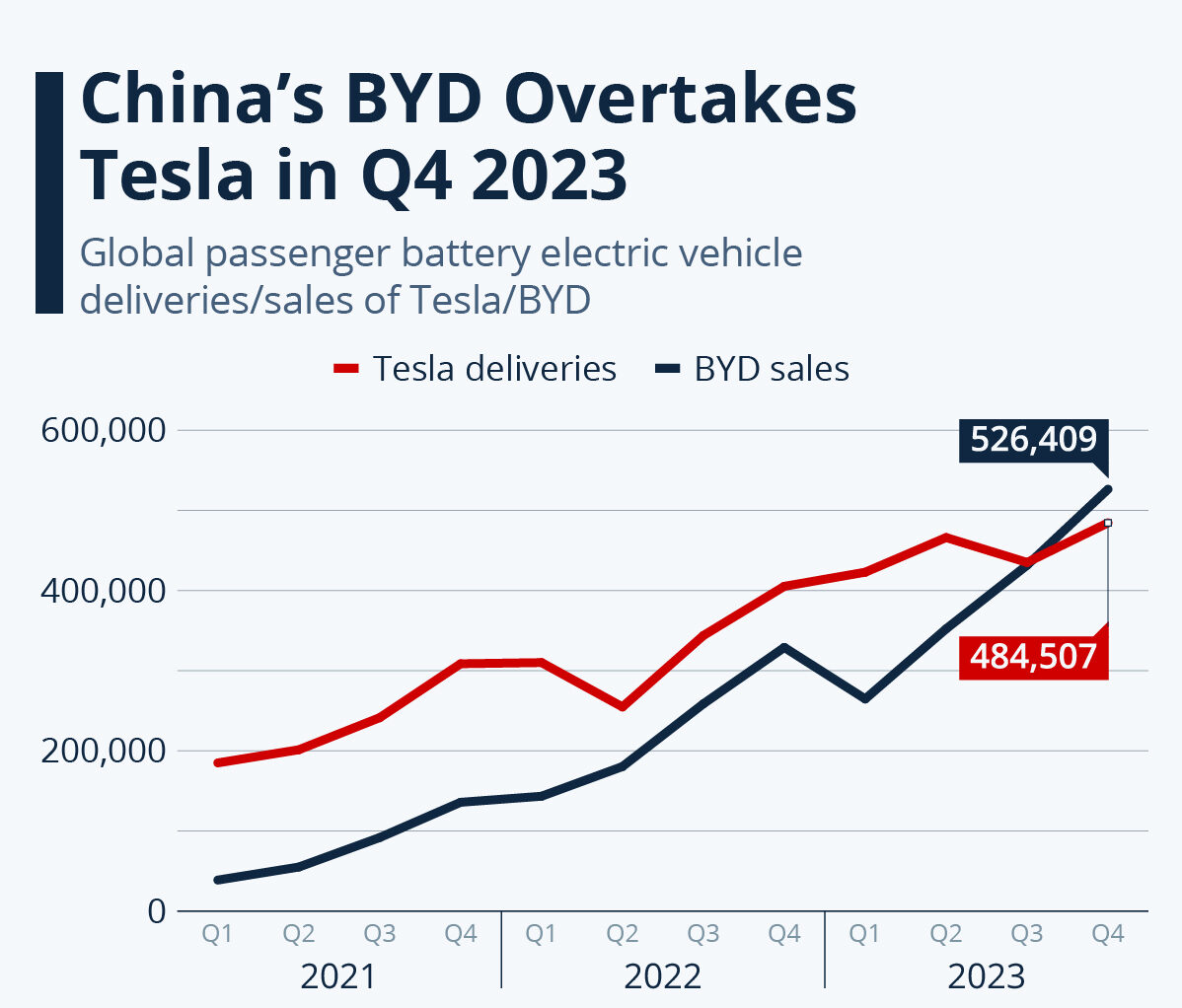

BYD, a Chinese automaker, has made a strong entry into Europe with affordable models like the Seal and Dolphin, which are rapidly gaining market share.

European Automakers Step Up

- Volkswagen: Improved its ID lineup, appealing to a broader audience.

- Polestar (Volvo): Attracting premium customers with sleek designs and performance.

- Mercedes and BMW: Competing in the luxury segment with the EQ and i series, offering superior finish and after-sales service.

Affordable EVs

Renault and Stellantis are targeting the mass market with affordable models like the Renault 5 E-Tech and Citroën ë-C3, segments where Tesla has no presence.

Structural Challenges: Beyond Musk and Competition

Reduced Government Incentives

The reduction or elimination of EV subsidies in key markets like Germany has hit Tesla hard, as its models often exceed price thresholds for the most generous incentives.

Quality and Service Issues

Tesla’s reputation for poor build quality and slow after-sales service is deterring potential buyers. While early adopters tolerated these issues, mainstream customers are less forgiving.

Distribution Model Limitations

Tesla’s direct-to-consumer sales model, once revolutionary, is struggling against the established dealership networks of traditional automakers. The lack of local service centers is a significant barrier for many European buyers.

Can Tesla Recover? Strategies for a Comeback

Distance Musk from the Brand

Tesla must separate Elon Musk’s personal views from its corporate image to mitigate the impact of political controversies.

Develop Europe-Specific Models

Tesla needs to accelerate the development of compact, affordable vehicles tailored to European tastes and infrastructure.

Improve Quality and Service

Expanding service centers and enhancing after-sales support are critical to regaining consumer trust.

Aggressive Pricing

To counter Chinese competitors, Tesla may need to adopt more competitive pricing, even if it means sacrificing margins in the short term.

Focus on Customer Retention

Loyalty programs and exclusive software updates could help retain existing customers and rebuild brand loyalty.

Tesla at a Crossroads in Europe

Tesla’s future in Europe hinges on its ability to adapt to a rapidly changing market. The era of unchallenged dominance is over, and the company must now prove its resilience in the face of fierce competition, shifting consumer preferences, and internal challenges. For Tesla, regaining the trust of European consumers may be an even greater challenge than leading the EV revolution in the first place.